Need to Correct an IRS 1094-C or 1095-C Form?

Points North • May 14, 2019

You’ve completed your reporting obligation for the Affordable Care Act. How do you know if you need to file a correction?

That depends on the error. There are errors that need to be submitted as corrections and others that do not require filing a correction. For this discussion, let’s assume there are errors that require corrections.

1094-C Corrections

The first thing to note is that a 1094-C is only marked as “Corrected” if there is an error on the 1094-C form itself. That means that a data element on the 1094-C was incorrect, such as the legal company name, not information on one of the accompanying 1095-C forms.

The 1094-C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095-C forms. The accompanying 1094-C form is simply a new form and the data on it should reflect what is being submitted with it (e.g., if 1 form needs correcting, Line 18 on the 1094 form will state “1” even though hundreds of forms were submitted originally).

It’s important to note that if a submission was “Rejected” by the IRS, employers should NOT mark the original submissions as corrected when resubmitting. Corrections only take place when you are changing data elements on a form.

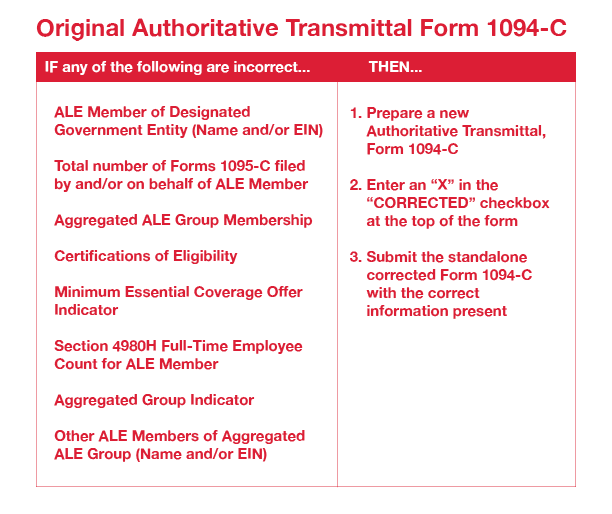

The table below describes the errors that must be corrected:

That depends on the error. There are errors that need to be submitted as corrections and others that do not require filing a correction. For this discussion, let’s assume there are errors that require corrections.

1094-C Corrections

The first thing to note is that a 1094-C is only marked as “Corrected” if there is an error on the 1094-C form itself. That means that a data element on the 1094-C was incorrect, such as the legal company name, not information on one of the accompanying 1095-C forms.

The 1094-C form is not considered a correction by the IRS if it is being submitted as the cover page for one or more corrected 1095-C forms. The accompanying 1094-C form is simply a new form and the data on it should reflect what is being submitted with it (e.g., if 1 form needs correcting, Line 18 on the 1094 form will state “1” even though hundreds of forms were submitted originally).

It’s important to note that if a submission was “Rejected” by the IRS, employers should NOT mark the original submissions as corrected when resubmitting. Corrections only take place when you are changing data elements on a form.

The table below describes the errors that must be corrected:

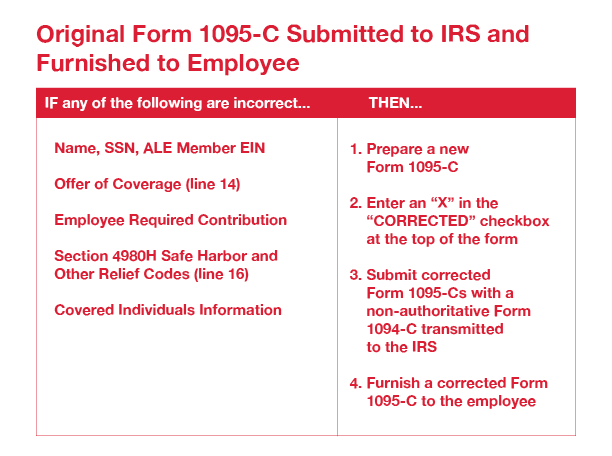

1095-C Corrections

Only 1095-C forms that have been filed with the IRS are considered “Corrected.” If you have furnished the 1095-C form to the recipient but have not filed the form with the IRS, the “Corrected” box should not be checked. Instead, simply write, type, or print “CORRECTED” on the new Form 1095-C and furnish it to the recipient. The form will be considered an original version when it is submitted to the IRS.

IMPORTANT: Enter an “X” in the “CORRECTED” checkbox only when correcting a Form 1095-C previously filed with the IRS.

If the 1095-C has been submitted to the IRS and an error is noted, the “Corrected” box at the top right must be checked in order to notify the IRS that the form has been updated and is being resubmitted as a correction.

The table below shows the types of corrections that must be submitted to the IRS:

Only 1095-C forms that have been filed with the IRS are considered “Corrected.” If you have furnished the 1095-C form to the recipient but have not filed the form with the IRS, the “Corrected” box should not be checked. Instead, simply write, type, or print “CORRECTED” on the new Form 1095-C and furnish it to the recipient. The form will be considered an original version when it is submitted to the IRS.

IMPORTANT: Enter an “X” in the “CORRECTED” checkbox only when correcting a Form 1095-C previously filed with the IRS.

If the 1095-C has been submitted to the IRS and an error is noted, the “Corrected” box at the top right must be checked in order to notify the IRS that the form has been updated and is being resubmitted as a correction.

The table below shows the types of corrections that must be submitted to the IRS:

When to Make Corrections

Quite simply, a corrected return should be filed as soon as possible after an error is discovered.

For additional information on filing corrections, visit the IRS site (irs.gov) or refer to the instructions at https://www.irs.gov/pub/irs-pdf/i109495c.pdf.

Quite simply, a corrected return should be filed as soon as possible after an error is discovered.

For additional information on filing corrections, visit the IRS site (irs.gov) or refer to the instructions at https://www.irs.gov/pub/irs-pdf/i109495c.pdf.

Once employers have familiarized themselves with the ACA obligations, they should also know of the penalties associated with non-compliance. Identifying and paying for full-time employees is fairly easy because of the straightforward details of their job but for variable hour employees’, it is not as simple. Some organizations make use of the ‘limiting’ strategy to manage such schedules but this strategy as its own set of problems. Problems such as workforce scheduling and variable labor requirements are factors that make this strategy impracticable. We’ve combined some of the best ways to ensure ACA compliance in this article and examined how ‘guidance’ can help you limit penalties.

The new year brings new policies and regulations, so it's important to do a comprehensive review and update of your legal and HR compliance to make sure that you're on top of any new laws and regulations. Begin 2020 on the right foot, with the knowledge you'll need to answer any questions from corporate leadership, supervisors, and employees. Here's what you need to know.

As the fiscal year closes the employers have many queries regarding the status of the Affordable Care Act (ACA) Reporting. It is questioned every time the tax filing season looms. The answer to all these queries is that Yes! ACA is still the law and employers who tend to ignore their obligations towards ACA reporting can face some heavy penalties.

It is important to choose a reliable and secure data aggregation solution which provides you with the best data. If you manage to get financial data which is cleaned and enriched then you can make accurate assessments of the financial situation of your customers. Following are some of the things which you should look for while choosing a solution to data aggregation.

Due to the complexity of the process, utilizing a reputable software vendor to file your 1094/1095 data electronically with the IRS is considered to be a best practice. One reason for this is that if it turns out that there’s a problem with some of your ACA data, the IRS doesn’t necessarily make it easy to figure out what went wrong.