Eleven IRS Form 1095-C Code Combinations That Could Mean Potential Penalties

Points North • May 14, 2019

The 1095-C form is used by employers with 50 or more full-time and full-time equivalent employees (also referred to as applicable large employers or ALEs) to report information required under Section 6056 of the Affordable Care Act. This includes their offers of health coverage and the employees’ enrollment in health coverage.

Part II (Lines 14-16) of the 1095-C provides information by month about the type of coverage that was offered, to whom it was offered, the cost to the employee for employee-only coverage, and any safe harbors or other relief that the employer reports. These lines are completed using a complex combination of indicator codes. These codes are required to be used in combination with not only each other, but also the employee’s full-time ACA status for each month and, in some cases, for the entire year.

There are currently 90 possible indicator code combinations for Lines 14 and 16, with just over half them being valid combinations (a code combination of 1H and 2C, for example, would be entirely invalid because 1H indicates that no offer was made, yet 2C indicates than an employee enrolled in coverage).

Valid Indicator Code Combinations that May Trigger a Penalty

While invalid code combination may result in a rejected form, there are some code combinations that could trigger an IRS penalty if the employee enrolls through the Marketplace.

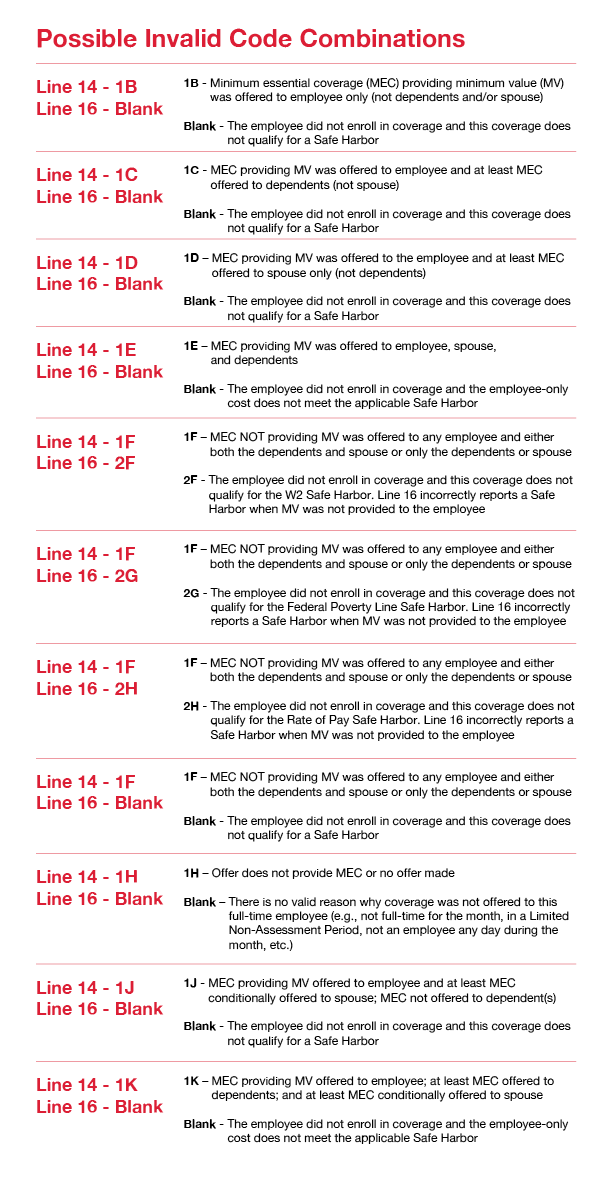

There are 11 of these valid code combinations to watch for on your employee’s 1095-C forms. The chart below details these combinations:

Part II (Lines 14-16) of the 1095-C provides information by month about the type of coverage that was offered, to whom it was offered, the cost to the employee for employee-only coverage, and any safe harbors or other relief that the employer reports. These lines are completed using a complex combination of indicator codes. These codes are required to be used in combination with not only each other, but also the employee’s full-time ACA status for each month and, in some cases, for the entire year.

There are currently 90 possible indicator code combinations for Lines 14 and 16, with just over half them being valid combinations (a code combination of 1H and 2C, for example, would be entirely invalid because 1H indicates that no offer was made, yet 2C indicates than an employee enrolled in coverage).

Valid Indicator Code Combinations that May Trigger a Penalty

While invalid code combination may result in a rejected form, there are some code combinations that could trigger an IRS penalty if the employee enrolls through the Marketplace.

There are 11 of these valid code combinations to watch for on your employee’s 1095-C forms. The chart below details these combinations:

While these indicator code combinations are valid, they may trigger a penalty if an employee enrolls for coverage through the Exchange. Check for any of these code combinations and make sure that the data that was used to determine them is accurate (e.g., coverage offered definition is correct, $ amount in Line 15 accurately shows the employee share of employee-only coverage—not necessarily what they enrolled in, etc.).

Also, always refer to the current year’s 1095-C instructions for the indicator code descriptions, as they may change from year to year. Here’s a link to the 2018 Instructions.

Also, always refer to the current year’s 1095-C instructions for the indicator code descriptions, as they may change from year to year. Here’s a link to the 2018 Instructions.

Disclaimer: The information provided within is for general informational purposes only. It does not necessarily address all of your specific questions or issues. It should not be construed as, nor is it intended to provide, legal advice. Questions regarding specific issues and application of these rules to your 1095-C reporting should be addressed by your legal counsel.

Once employers have familiarized themselves with the ACA obligations, they should also know of the penalties associated with non-compliance. Identifying and paying for full-time employees is fairly easy because of the straightforward details of their job but for variable hour employees’, it is not as simple. Some organizations make use of the ‘limiting’ strategy to manage such schedules but this strategy as its own set of problems. Problems such as workforce scheduling and variable labor requirements are factors that make this strategy impracticable. We’ve combined some of the best ways to ensure ACA compliance in this article and examined how ‘guidance’ can help you limit penalties.

The new year brings new policies and regulations, so it's important to do a comprehensive review and update of your legal and HR compliance to make sure that you're on top of any new laws and regulations. Begin 2020 on the right foot, with the knowledge you'll need to answer any questions from corporate leadership, supervisors, and employees. Here's what you need to know.

As the fiscal year closes the employers have many queries regarding the status of the Affordable Care Act (ACA) Reporting. It is questioned every time the tax filing season looms. The answer to all these queries is that Yes! ACA is still the law and employers who tend to ignore their obligations towards ACA reporting can face some heavy penalties.

It is important to choose a reliable and secure data aggregation solution which provides you with the best data. If you manage to get financial data which is cleaned and enriched then you can make accurate assessments of the financial situation of your customers. Following are some of the things which you should look for while choosing a solution to data aggregation.

Due to the complexity of the process, utilizing a reputable software vendor to file your 1094/1095 data electronically with the IRS is considered to be a best practice. One reason for this is that if it turns out that there’s a problem with some of your ACA data, the IRS doesn’t necessarily make it easy to figure out what went wrong.